See beyond the numbers. Hear the market whispers.

StockWisp analyzes 10-Q filings and market news to surface clean, actionable signals: Bullish, Bearish, or Neutral. Build watchlists, compare companies side-by-side, and cut through the noise.

Signals that actually help you decide

Inspired by crisp, developer-grade UX, tailored for investors.

AI filing analysis

Parse 10-Q language to quantify tone and risk. Summaries you can read in seconds, not hours.

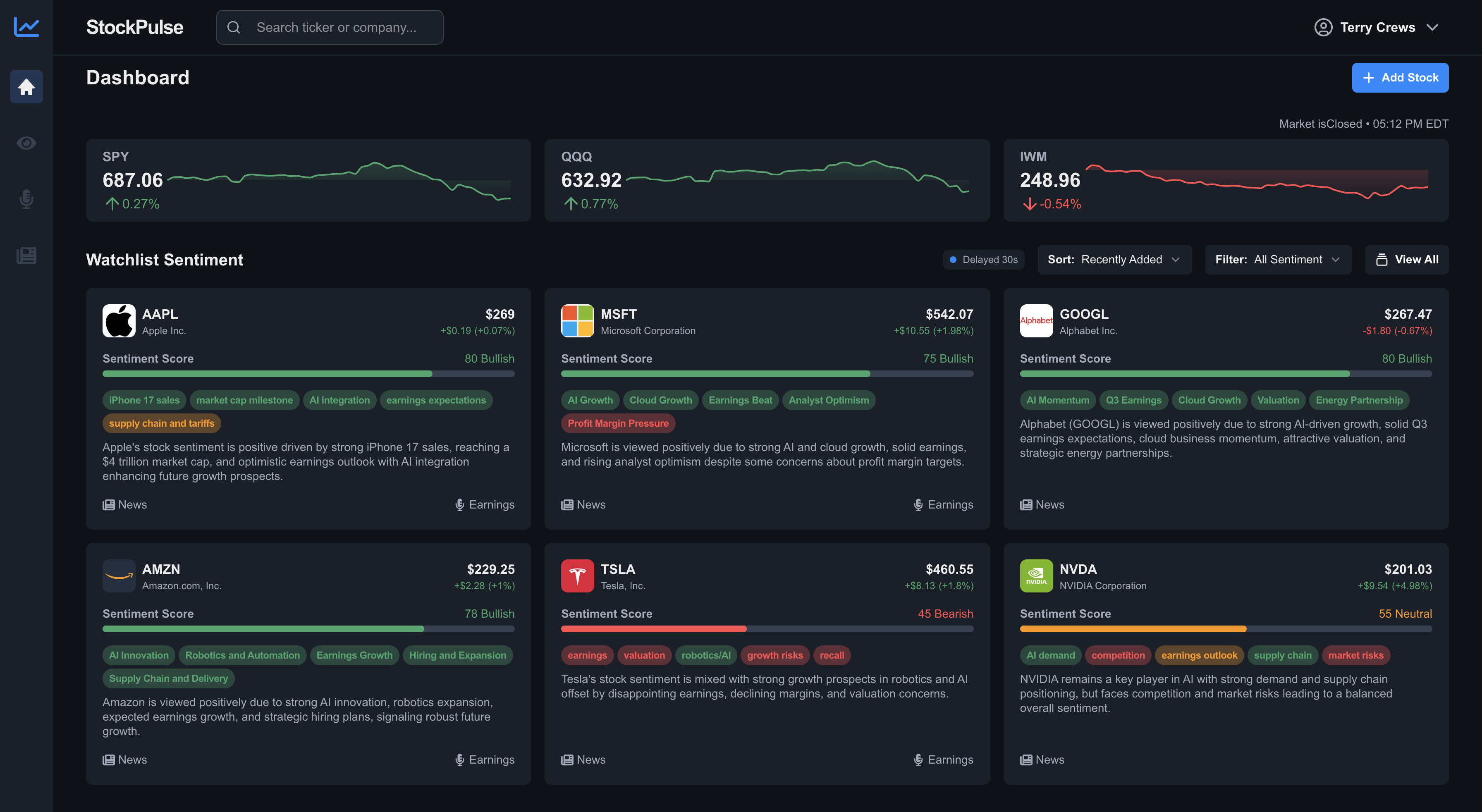

Sentiment at a glance

Every stock gets a Bullish / Bearish / Neutral label with a confidence score and key drivers.

AI Comparison Mode

Compare filings side-by-side—highlighting tone shifts, guidance changes, and risk wording.

Watchlists & quick look

Track your symbols and jump to distilled stats, news, and upcoming earnings in one click.

Market context

Blend filing tone with recent headlines to understand what’s moving sentiment today.

Privacy-respecting

No ads and minimal tracking. Your research stays yours.

Add tickers

Create a watchlist or paste a few symbols to start (e.g., NVDA, AMD, MU).

Run analysis

We process 10-Qs and curated news, then compute a sentiment score and label.

Act with clarity

Skim the summary, dive deeper on highlights, or compare companies side-by-side.

TSLA (TSLA)

Tesla reported Q3 2025 revenues of $28.10B, up 12% YoY, driven by automotive sales growth and strong energy generation and storage segment performance. Net income attributable to common stockholders was $1.37B, down YoY due to lower regulatory credits and higher expenses. The company continues to invest heavily in AI...

AAPL (AAPL)

Apple reported Q2 2025 revenues of $94.68B, up 8% YoY, driven by strong iPhone sales and growth in services and wearables segments. Net income was $25.01B, reflecting a 6% YoY increase, supported by operational efficiencies and a favorable product mix. The company is focusing on innovation in AI and AR technologies to drive future growth...

Simple flow, serious depth

Select a company. We parse the latest 10-Q and relevant news. Our models score tone and extract key factors, then present a clean summary with citations so you can verify.

- Filing tone & risk deltas

- Headline-weighted sentiment

- Confidence score with drivers

- Comparison Mode for A/B companies

AMD

ADVANCED MICRO DEVICES

$233.76

+$3.53

(+1.53%)

Sentiment Score

75 Bullish

AMD is viewed positively due to strong AI-related partnerships, especially with OpenAI, expected earnings growth, and increasing demand for AI chips, despite some competitive pressures and market caution.

NVDA

NVIDIA CORPORATION

$469.23

+$10.72

(+2.34%)

Sentiment Score

82 Bullish

NVIDIA is receiving positive sentiment due to its strong earnings report, leadership in AI technology, and strategic partnerships, despite some concerns about market competition and regulatory scrutiny.

Frequently asked

Short, honest answers.

What does “beta” mean here?▾

You’re getting early access while we iterate quickly. Expect frequent updates, occasional rough edges, and possible data delays. Your feedback helps shape what we build next.

Is StockWisp free?▾

Yes. StockWisp is currently free for everyone while we iterate. Real-time prices may be delayed on free data tiers.

Do you analyze earnings calls?▾

Right now we focus on 10-Q filings and curated headlines. Earnings-call analysis is on our roadmap.

Do you track institutional holdings?▾

Institutional ownership dashboards require paid data sources. For now, we prioritize filing tone, sentiment, and news context.

Research faster. Decide smarter.

Plug in your tickers and see where the tone is heading. No credit card. No waitlist.